On December 29, 2022, the Ministry of International Trade and Industry of Malaysia issued an announcement stating that in response to the application submitted by the Vietnamese exporter Tan Phuoc Khanh Trading Manufacturing Coil Steel JSC,

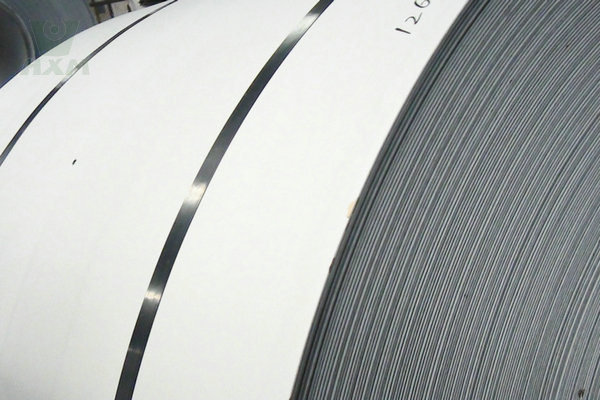

it was decided to apply for aluminum plating produced or exported by Vietnam Tan Phuoc Khanh Trading Manufacturing Coil Steel JSC Flat Rolled Product of Non-alloy Steel Plated or Coated with Aluminum and Zinc (Flat Rolled Product of Non-alloy Steel Plated or Coated with Aluminum and Zinc) launched an anti-dumping administrative review investigation. The final ruling of this case will be made within 180 days from the date of filing the case.

Questionnaires will be distributed to relevant importers, manufacturers, exporters, and associations, and other stakeholders should receive questionnaires from the Ministry of International Trade and Industry of Malaysia no later than January 13, 2023, and no later than January 28, 2023 Submit the questionnaire and relevant supporting materials to the Ministry of International Trade and Industry of Malaysia on the following day.

On March 17, 2020, the Ministry of International Trade and Industry of Malaysia issued an announcement, in response to the application submitted by NS Bluescope Malaysia Sdn.

Anti-dumping investigation. On December 23, 2020, the Ministry of International Trade and Industry of Malaysia issued an announcement to make an affirmative final ruling on the anti-dumping of galvanized sheets originating in or imported from China, South Korea, and Vietnam and decided to target the products involved in China, South Korea, and Vietnam Anti-dumping duties are levied, among which the anti-dumping duty rates for the products involved in China are 2.18% to 18.88%, that of South Korea is 9.98% to 34.94%, and that of Vietnam is 3.06% to 37.14%.

The measure will come into effect on December 12, 2020, and will end on December 11, 2025, with a validity period of five years. The Malaysian Harmonized Tariff Codes of the products involved are 7210.61.1100, 7210.61.12 00, 7210.61.1900, 7210.61.91 00, 7210.61.9200, 7210.61.99 00, 7212.50.23 00, 7212.50.24 90, 7212.5 and 7212.50.29 90.